The NYP new hire onboarding process includes verification of employment history. In some cases, our background screening vendor Certiphi is unable to successfully verify employment, and we may request additional documentation from our new hires in order to complete this required step. Examples of acceptable documentation may include letters of verification from employer, pay stubs, W-2s, or 1099s. Please redact any confidential/personal information such as Personally Identifiable Information (DOB/SSN etc.) and salary before sending NYP this documentation.

Hires may need to request their Wage and Income transcript from IRS. The Wage and Income transcript shows data received by the IRS from information returns provided by individuals on their Forms W-2s and 1099s. This transcript is available online for up to 10 prior years.

What you need to register and use this service:

- Your social security number, date of birth, filing status and mailing address from latest tax return

- Access to your email account

- Your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan

- A mobile phone and U.S. based mobile phone number

How it Works:

-

Click “Get Transcripts Online”

-

Click create an account or Log In (If logging in, skip to step 18) (If you are creating a new account continue to step 4)

-

Click continue to acknowledge you need to register for this IRS service.

-

Click yes to acknowledge if you have the required personal information and material to complete the registration.

-

Click yes to acknowledge if you have one of the financial account identifiers to complete the registration.

-

Click continue to acknowledge if you have a U.S. based mobile phone number OR a verified address to receive the verification code. (The easiest and fastest way to receive this code is by text message SMS, but you can still receive this code by mail. You will still need a U.S. based mobile phone number OR a web enabled mobile device to complete this registration)

-

Enter your first name and last name as it appears on your most recent tax return (exclude the middle initial.)

-

Enter and confirm your email address (make sure you have access to this email) and click send code

-

Open your email in a new window. You should have received an email with a confirmation code. The subject line will be “Confirmation Code: Verify your email address” from online.services@irs.gov. Enter the code listed in the email on the IRS website and click continue. (This code is only valid for 15 minutes)

-

Enter your date of birth, social security number, filing status, and address (this information MUST match your most recent filed tax return) and click continue.

-

Enter a financial account number and click continue (this information will only be used to verify your identity, you will not be charged for this service).

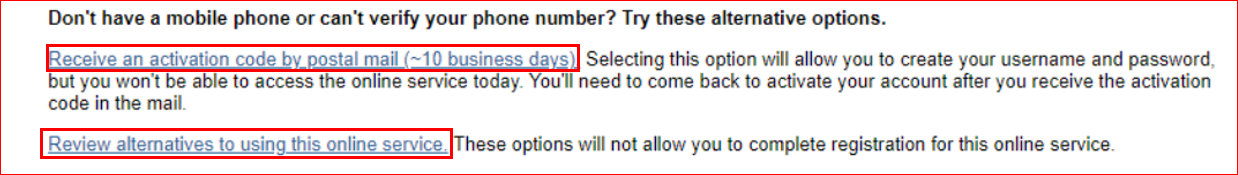

- Enter your U.S. based mobile phone number and click send message OR you can choose to receive the activation code by postal mail within 10 business days.

-

For the text message, you should receive a text with an IRS password service security code. Enter the 6-digit activation code and click continue.

-

Create a username and password according to the site requirements.

-

Choose a Site Phrase and Site Image that you will recognize and click continue.

-

You should then receive an email with the subject line will be “User Profile has been created” from online.services@irs.gov.

-

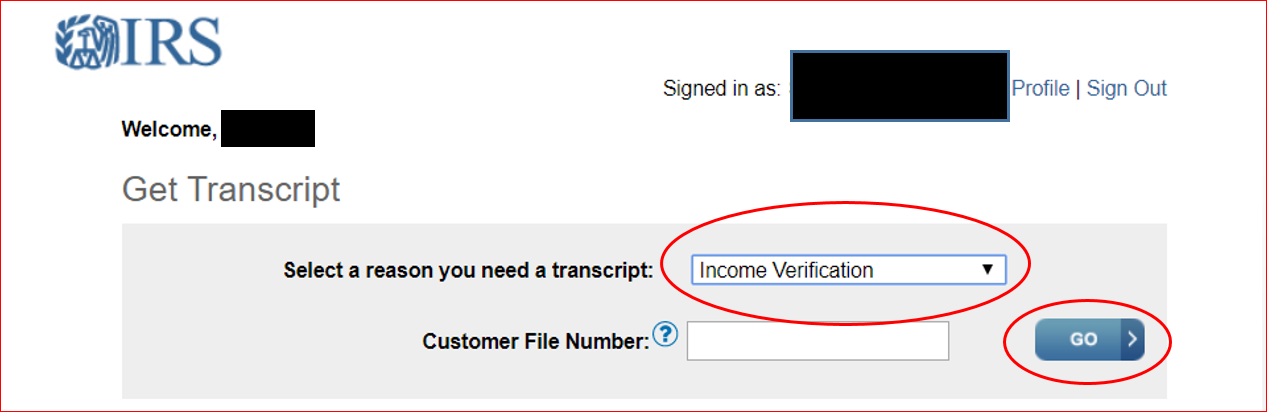

On the IRS website select “Income Verification” as the reason you need a transcript.

-

Leave the “Customer File Number” BLANK and click GO

-

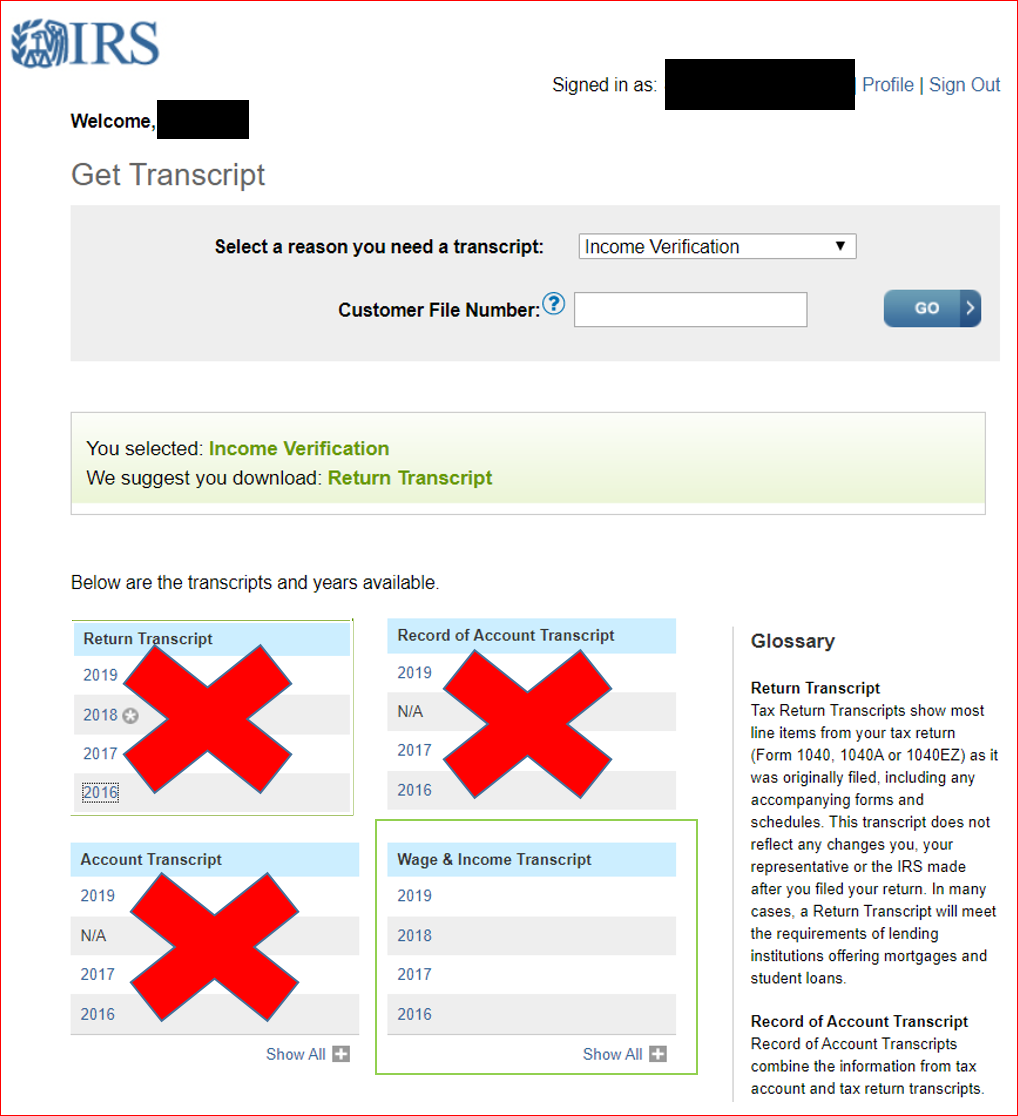

Download and save your “Wage & Income Transcript” for the years requested by your HR Connects Coordinator. Please redact any confidential/personal information such as Personally Identifiable Information (DOB/SSN etc.) and salary before sending NYP this documentation.

-

Click here to upload any applicable documentation to our secure file drop.

-

Inform your HR Connects Coordinator when you have submitted your transcripts to the file drop.

For More Information:

Please contact HR Connects through the chat at the bottom right of your screen.

CN1-12